This presentation was given by ASH as part of a debate organised by Antarsya, an anti-capitalist co-operation of the Left in Greece, held at the School of Oriental and African Studies, University of London, on 15 June, 2019. A recording of the entire event, which included presentations by Michael Roberts and Nikos Kapitsinis, is available below.

In the good old days – before 23 June 2016 – when barely a week passed without some new demonstration or protest against the latest round of austerity measures, cuts to benefits, Atos deaths, privatisation of the NHS, dismantling of the welfare state, erosion of civil liberties, expansion of police powers, deportation of immigrants or declaration of war, it was still widely agreed that the most pressing political issue in the UK was the crisis of housing affordability. Four years later, that issue has fallen down the hierarchy of the public’s attention. Why campaign to save something as boring as social housing when you can SAVE THE WORLD? But housing is not only an aspect of British life about which, drawing on the work of Architects for Social Housing, I can speak with some knowledge about how it has been influenced by our membership of the European Union; it is also where different strands of UK society – economic, political and social – converge. Housing, therefore, is a prism through which to test the truth value of the claims about our membership of the EU, as well as the counter arguments for leaving. I can’t today go into the arguments for remaining, but they all imply that since 1973, when the UK belatedly joined the European Economic Community, we’ve been living through a Golden Age of economic growth and wealth creation, of unprecedented peace between the formerly warring nations of Europe, of multicultural tolerance and the rule of human rights in this best of all possible worlds. But what does housing reveal about the economic, political and social realities of the pre-Brexit Garden of Britain from which, like a modern-day Adam and Eve, we’re so rashly attempting to eject ourselves?

1. UK Housing in the European Union

Unlike, for example, the way the European Union’s 4th Railway Package has imposed the privatisation of their railway services on member states, the influence of EU legislation on housing provision is less clear cut. The line between Neo-liberalism as a late stage of capitalism since the 1970s and the EU as a legislative instrument of its implementation is blurred – or at least it is to me, as I am not an expert on EU legislation. But current UK housing policy, which I do know something about, is based on three neo-liberal principles:

- That attracting investment in UK residential property from the private sector, including foreign investors, overseas buyers and offshore financial jurisdictions, should be the primary source of revenue for house building;

- That according to the law of supply and demand, massively increasing the supply of residential properties for market sale will reduce house prices in general;

- That the sale of prime and super-prime residential properties for the highest possible market price will cross-subsidise the provision of the so-called ‘affordable housing’ in which UK citizens can afford to live.

Now, all three of these principles are fundamentally flawed as a model for the provision of housing need:

- Because private investment in the UK property market has transformed our housing into a global commodity, with investors, for example, speculating on shares in the value uplift consequent upon planning permission being granted on a piece of land they will never see and which may never even be developed;

- Because the law of supply and demand doesn’t describe this property market, whose financialisation by global capital has driven prices up, as it is intended to, rather than down;

- Because far from cross-subsidising even affordable housing, let alone homes for social rent, such investment is instead funding the estate regeneration programme that is demolishing tens of thousands of council homes to make way for the development of primarily market-sale properties.

As a result of these policies, between 2014 and 2016, around one in six new-build residential properties in London were sold to overseas investors. In 2017, that figure rose to 30 per cent; and in the second half of 2018, overseas investors purchased 57 per cent of all homes in Central London. Although some overseas buyers might use their property as a home for a week or so during the year, most investors are either buy-to-let landlords or speculators on London’s housing market.

Partly as a result of this investment, the total value of the UK housing stock in 2018 was £7.29 trillion, having risen by a third over the last decade alone. Nobody will be surprised to hear that £1.77 trillion of that housing stock is in London, nearly a quarter of the total. Equivalent to 3.45 times the gross domestic product of the UK, and nearly 60 per cent of the UK’s entire net wealth, the UK property market now constitutes an economy in itself. And it is this that UK housing policy is being written to keep afloat – at the cost of the housing of its citizens.

58 per cent of housing demand in London is for lower-mainstream properties and homes for sub-market rent; yet only a quarter of the properties with planning permission in the five years between 2017 and 2021 will go on sale at this price. As a result, the number of unsold residential properties under construction in London reached a record high of 31,500 last month; while the total number of unsold new-build properties on sale for more than £1 million has hit a record high of 3,000 units. At the other end of the financial scale, of the 45,500 residential units completed in London in 2016/17, only 16 per cent were even affordable housing; and of these, a mere 5 per cent were for social rent, the lowest cost and most in demand tenancy type. The remaining 84 per cent was for market sale properties.

In the decade since the financial crisis, London house prices have risen from an average of £245,000 in April 2009 to £463,000 today. That’s more than thirteen times the average London salary of £35,000. In Inner London, the average price of a new-build property is now £786,000. Meanwhile, rents on London’s private market, in which 30 per cent of London households have to find a home, have risen to an average of £1,617 per month, 73 per cent higher than the UK average of £936. The total rent paid by UK tenants last year rose to £51.6 billion, more than double the £22.6 billion they paid in 2007.

At the same time, there are 20,000 long-term empty homes in London alone, with more than ten times that number across England. Extraordinarily, half of the residential units in London’s new-build developments currently stand empty. Unsurprisingly, the likelihood of a residential property being empty rises with its market value. 39 per cent of properties worth between £1 million and £5 million are currently under-used, a figure that rises to 64 per cent for properties worth more than £5 million. Of the properties purchased by overseas investors, an appalling 42 per cent stand empty.

As a result of what the European Union would describe as this ‘liberalisation’ of UK housing provision, at the end of 2018 there were an estimated 165,000 people homeless in London, or 1 in 52 of the capital’s population, and over 300,000 homeless across the UK. These numbers, however, don’t include the hidden homeless, with an estimated 1 in 5 people under the age of 25 having couch-surfed last year – 225,000 of them in London. Roughly the same number, 244,000, are on council housing waiting lists in London. While across England, 1.16 million households are waiting for a council home.

Given the lack of response from the British public to the causes of this housing crisis, either in the polling booth or on the streets of London, my very strong suspicion is that middle-class Remainers in general care very little about the negative effects of Neo-liberalism on the working class so long as they continue to profit from it themselves, most noticeably from the rising value of their homes. Their well-mannered protests are not against the threat of these figures worsening if we leave the European Union, but expressive of their fears of becoming the victims, rather than the beneficiaries, of the Neo-liberalism responsible for them. Whether they know it or not – whether they admit it or not – those who vote to remain in the European Union are voting for more of the same if not worse.

2. UK Housing after the Referendum

In May 2016, the Sunday Times Rich List reported that 26 of the 100 wealthiest people in the UK listed property as a major source of their wealth; while among the richest 1000 there were 164 property moguls with a combined wealth of £143.7 billion. Perhaps unsurprisingly, the next month the UK Referendum returned a vote to leave the European Union by 52 per cent on a 72 per cent turnout of the UK electorate, some 17.4 million people. Since then, the value of the pound has fallen from €1.26 and $1.42 to, at the beginning of this week, €1.12 and $1.27, or 12 cents in the Euro and 15 cents in the US dollar. The immediate effect of this fall was that, by November 2016, 406,000 Britons had lost their status as dollar millionaires. More importantly, however, was the drop in investment in UK housing, and especially in London, as a safe place for global capital.

As an example and case study of this disinvestment, one of the schemes for which ASH has proposed design alternatives is the West Kensington and Gibbs Green council estates in Hammersmith and Fulham, whose residents we worked with in the 8 months leading up to the Referendum. Five years earlier, in June 2011, Capital & Counties Properties (or Capco), which also owns the adjoining Earl’s Court site, submitted a planning application to demolish and redevelop both estates. In September 2012, despite the scheme being opposed by 80 per cent of residents, Hammersmith and Fulham council granted outline planning permission; and the following April both estates were stock transferred to Capco for £90 million. This was later estimated to be less than 10 per cent of their market value at the time.

Capco’s scheme proposed demolishing the 760 homes on the existing estates and replacing them with a total of 7,500 residential properties spread across the combined sites. Over 800 of these have been built on the Lillie Square development to the south, where 2-bedroom apartments went on sale for £1.2 million. 89 percent of the additional homes were to be for market sale, with none set aside for social rent. The 760 new dwellings allocated to replace the demolished council homes on the two estateswould be a mix of affordable rent, rent-to-buy schemes and shared ownership properties far beyond the reach of most Londoners.

It was thanks to cowboy schemes like this – and there are hundreds of them across London – that in the two years before the Referendum the UK property market expanded by £400 billion. However, in the uncertainty leading up to the Referendum, share prices for Capco started to drop, falling from £4.72 in August 2015 to £3.27 in March 2016. Following a slowdown in sales for the apartments in Lillie Square, Capco’s Managing Director said he feared the market for high-value residential dwellings in London was falling. He was right.

While the West Kensington and Gibbs Green estates are still standing, the demolition of the Earls Court Exhibition Centre began in December 2014, since which time the site has lost more than half its value. In fact, Capco’s land holdings in the venture lost 10.5 per cent of their value in the first three months of 2019 alone. According to a recent valuation, Capco’s share of the site is now worth £412 million, down from a pre-Referendum peak of £803 million in 2015.

As a result, despite sitting on planning permission since 2012, not a single unit of luxury housing has been built on the former Earl’s Court site. Last year Capco began looking for buyers on which to offload at least part of the land, but nobody has yet come forward. Capco’s share price has continued to drop, falling 54 per cent since its 2015 peak. Capco has admitted that this has primarily been down to a reduction in the gross development value of the site once building work is completed. Last month, Hammersmith and Fulham council announced it would be raising the capital to compulsory purchase the land on which the two council estates stand.

When outraged liberals demand to know how I can possibly be in favour of Brexit, I point to the levelling-off of house prices in England and the drop in house prices in London since the Referendum; to the pause in London’s estate demolition programme as overseas and offshore investors pull out of the UK property market; and to the fall in land values consequent upon both. These perceived negatives in the supposedly absolute good of economic growth on which capitalism relies for its profits are in effect positive forces against the so-called liberalisation of UK housing. Removing the barriers to re-nationalising housing provision in the UK, such as the EU-enshrined prohibition on State Aid, will require far more than leaving the European Union, beginning with overthrowing half a century of neo-liberal orthodoxy. But just the threat of doing so has already removed some of the financial incentives to continue pursing UK housing policy based on the investment needs of global capital rather than the housing needs of the UK population.

However, there’s a caveat to all this. Markets recoil from uncertainty, and perhaps – when Boris Johnson is installed in No. 10, as seems likely, and the new government removes what’s left of our building and planning regulations before inventing further financial incentives for the global ruling class to invest even more of their dirty money in UK property – the market will recover, and we really will look back on the years before Brexit as the ‘good old days’. But I don’t think so. Perception is crucial to markets, and since the Referendum dropped a turd into the cocktail-glass of Europe, London has lost its reputation as the second home for Europe’s jet-setting classes. So the customer base has contracted. Just as importantly, 275 City firms and £900 billion of financial assets have relocated out of the UK. That’s a lot of bankers, hedge-fund managers, financial advisors and corporate lawyers who will no longer be living or investing in London property. Most importantly of all, the Referendum, followed by the recent European Parliament Elections, have shown that the UK can no longer be regarded as under the thumb of the Conservative-Labour monopoly that will underwrite any sudden collapse in property values if and when the housing bubble bursts, as it did the banks after the global financial crisis. Perhaps, as some have predicted, the UK will become an offshore tax jurisdiction for global capital under the umbrella of US imperialism – although some would say London has already been that for some time. But there is another possibility.

3. The UK after Brexit

I doubt any of us who have suffered from the fiscal policies of austerity over the past decade have noticed the benefits of living in a country with the fifth largest economy in the world. Despite this, one of the apparently decisive arguments for remaining in the European Union is that a smaller GDP for a post-Brexit UK will increase social inequality. Now, the Gross Domestic Product of the world in 2018 was $80 trillion US dollars, and over a quarter of that, $20.5 trillion, came from the United States of America. To test the argument that greater national wealth means wider distribution of that wealth you only have to look at the US, the richest country in the history of the world, where wages have not increased in real terms since the 1970s, which has no national health cover, the highest number and percentage of citizens in prison of any country in the world, the highest spending on the military of any country in the world, a corrupt, politicised and militarised legal system, an institutionally racist police force and a fascist game-show host for a President. If that’s what a quarter of the world’s GDP gets you, maybe we could do with a different measure of the ‘wealth’ of our society.

Most of us have lived our entire lives within one form or other of the European Union, a period co-extensive with the rise of Neo-liberalism as the dominant economic and political system in Western democracies. And after 46 years of Neo-liberal governments, Conservative, Labour, Coalition and Conservative again, there is perhaps no more ideologically hegemonic country in Europe than the UK. Until now.

Whatever its consequences for us – and that will depend on what we do after we leave the EU – the threat of Brexit has opened a wound in the hegemony of Neo-liberal capitalism. This accounts, I’d suggest, for the almost exclusively and overwhelmingly emotive character of the reactions to it, as if we’re religious fanatics who have been told our God is dead and it’s time to find a new meaning to our lives. Personally, I’m a great believer in killing gods, which is the point of departure for the self determination of the working class kept servile by their worship. The apparently firm conviction that, free from the maternal embrace of Europe’s fulsome breast, we will automatically fall into the paternal grasp of our evil fathers, whether Boris Johnson or Donald Trump, shows just how childish and subservient we’ve become as an electorate, apparently capable only of choosing which brand of Neo-liberalism our political parties spoon feed us. It’s a measure of how complete has been the defeat of the political Left in this country that the only way liberals can think to defend themselves from the Conservative Right is to cling to the skirts of the European Union. If we’d spent half the effort we’ve squandered over the past three years arguing why we should remain part of the Neo-liberal Empire instead working to create a socialist alternative, we could be on the verge of a period of genuine political and economic change in the UK. We’re not. But that work starts now.

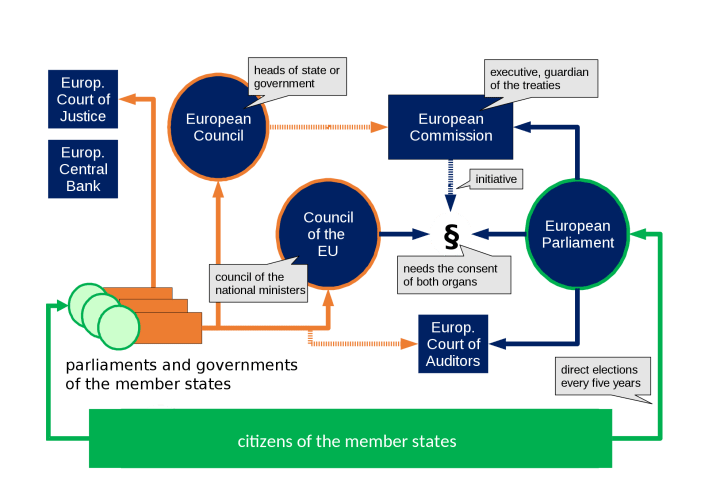

As the example of Greece has so brutally demonstrated, the European Union will not allow the democratically-elected socialist government of a member state to govern in anything but name. Unlikely as it may seem in this most conservative of countries, if the UK is ever to have a socialist government which, unlike Syriza, is not under the yoke of the unelected troika of the European Commission, the European Central Bank and the International Monetary Fund, escaping the iron grip of the European Union is the first – insufficient – but necessary step. Eating from the tree of knowledge always has its consequences, but how much longer do we want to live in ignorance and obedience to the God of Neo-liberalism?

Simon Elmer

Architects for Social Housing

Brief Chronology of the European Union

1948 Hague Congress

European Movement International

College of Europe

1949 Treaty of London (signed by Belgium, Denmark, France, Greece, Ireland, Italy, Luxembourg, Netherlands, Norway, Sweden, Turkey and the UK)

Council of Europe (promoting democracy and human rights)

1951 Treaty of Paris (signed by Belgian, France, Italy, Luxembourg, Netherlands, West Germany)

1952 European Coal and Steel Community (linking national industries)

Court of Justice of the European Coal and Steel Community

1953 European Convention on Human Rights

1957 Treaty of Rome (signed by Belgium, France, Italy, Luxembourg, the Netherlands, and West Germany)

1958 European Economic Community (EEC) (customs union)

European Atomic Energy Community

Court of Justice of the European Communities

European Parliamentary Assembly

1959 European Court of Human Rights

1960 Stockholm Convention (signed by Austria, Denmark, Norway, Portugal, Sweden, Switzerland, the UK)

European Free Trade Association (EFTA)

1962 European Parliament

Algeria leaves the EEC upon independence from France

1965 Commission of the European Communities

1967 Merger Treaty

European Communities (merger of three Communities into single institution)

Council of the European Economic Community

1973 EEC enlarged to include Greenland, Ireland, Denmark and the UK (the latter two leaving the EFTA)

1975 European Council (decides political strategy)

European Court of Auditors (audits management of finances)

1979 European Parliament members directly elected for the first time

1981 Greece joins the EEC

1985 Schengen Agreement (open borders between 22 EU member states)

Greenland leaves the EEC

1986 Spain and Portugal joins the EEC (the latter leaving the EFTA)

1990 Former East Germany joins EEC as part of unified Germany

1992 Maastricht Treaty

1993 European Union (EU)

Council of the European Union (legislative body)

1995 Austria, Finland and Sweden join the EU (after leaving the EFTA)

1998 European Central Bank (administers monetary policy within Eurozone)

2002 Eurozone (Euro replaces currency of Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain)

2004 Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia and Slovenia join the EU

2007 Lisbon Treaty

European Commission (executive body whose unelected members are proposed by the Council of the European Union)

Bulgaria and Romania join the EU

Slovenia adopts the Euro

2008 Global financial crisis

Cyprus and Malta adopt the Euro

2009 Lisbon Treaty

EU becomes single legal entity with a permanent President of the European Council

Court of Justice of the European Union (enforces compliance of member states to EU treaties)

Slovakia adopts the Euro

2010 Beginning of Euro debt crisis (Greece, Portugal, Ireland, Spain, Cyprus)

2011 Estonia adopts the Euro

2013 Croatia joins the EU

2014 Latvia adopts the Euro

2015 Lithuania adopts the Euro

2016 UK votes to leave the European Union

2019 Brexit?